Capabilities

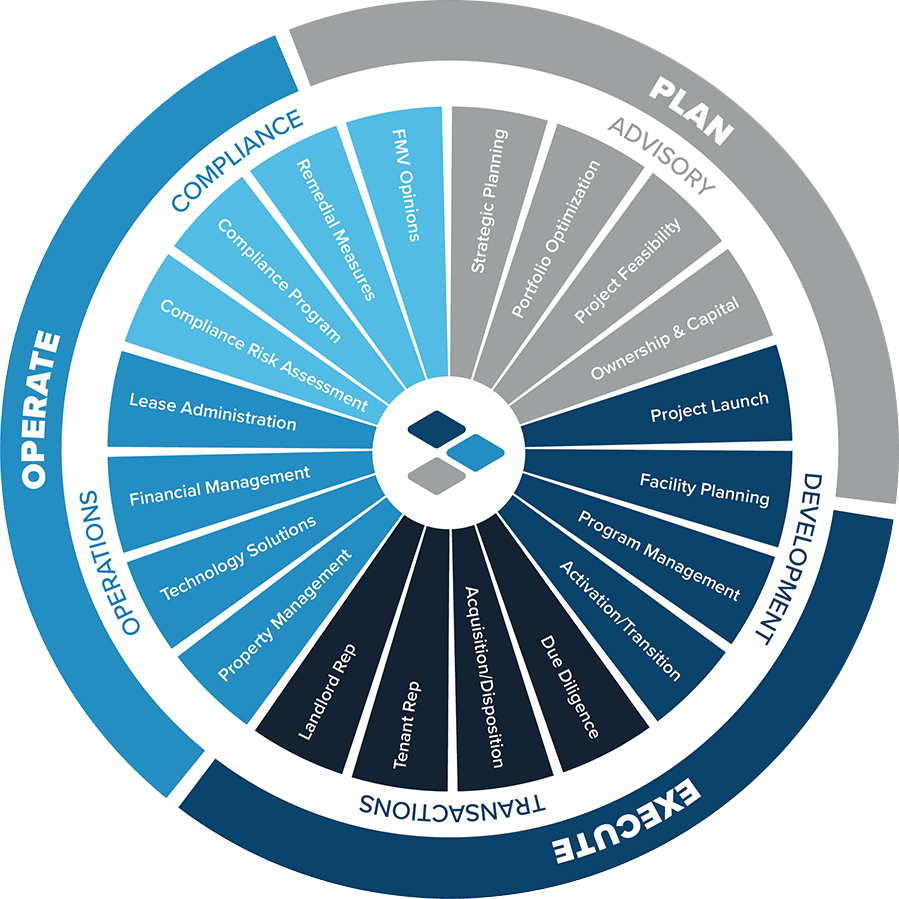

Providing innovative real estate solutions so that healthcare leaders save money, manage risks, and enhance delivery of care.

Objective real estate advisory services spanning strategic, operational and financial planning considerations.

Professional Program Management services that ensure the successful delivery of acute care and ambulatory facility development.

Completing profitable and compliance driven transaction objectives that follow the strategies of physicians and hospitals.

Comprehensive real estate operations support, including property, facility and financial management services.

Providing comprehensive analysis to ensure compliance with all applicable legal and regulatory requirements.

RTG360 is an integrated service platform used to create customized solutions to your complex challenges. Our diverse service lines and depth and breadth of experience work together to provide perspective that few can match.

Portfolio Management Services

Healthcare real estate arrangements can present numerous compliance pitfalls, any of which can trigger a violation under the Stark Law and Anti-Kickback Statute. An effective portfolio management approach requires a comprehensive understanding of the applicable statutes and integration of proper controls into corporate real estate policies and procedures.

What our clients say

RTG differs from other firms because they focus on the healthcare side of commercial real estate,

but also have the understanding and connections for the legal, accounting, and tax side of things. They have a good 360 degree view of everything related to medical real estate.

— Jeff Dew, CEO of Gastrointestinal Associates